Fuel Tax Examples . for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). States levy taxes on fuel in a few different ways,. the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. today’s map illustrates gas tax rates across states for 2024. in response to a year of extreme energy price increases in 2022, many european countries offered partial relief through temporary fuel tax.

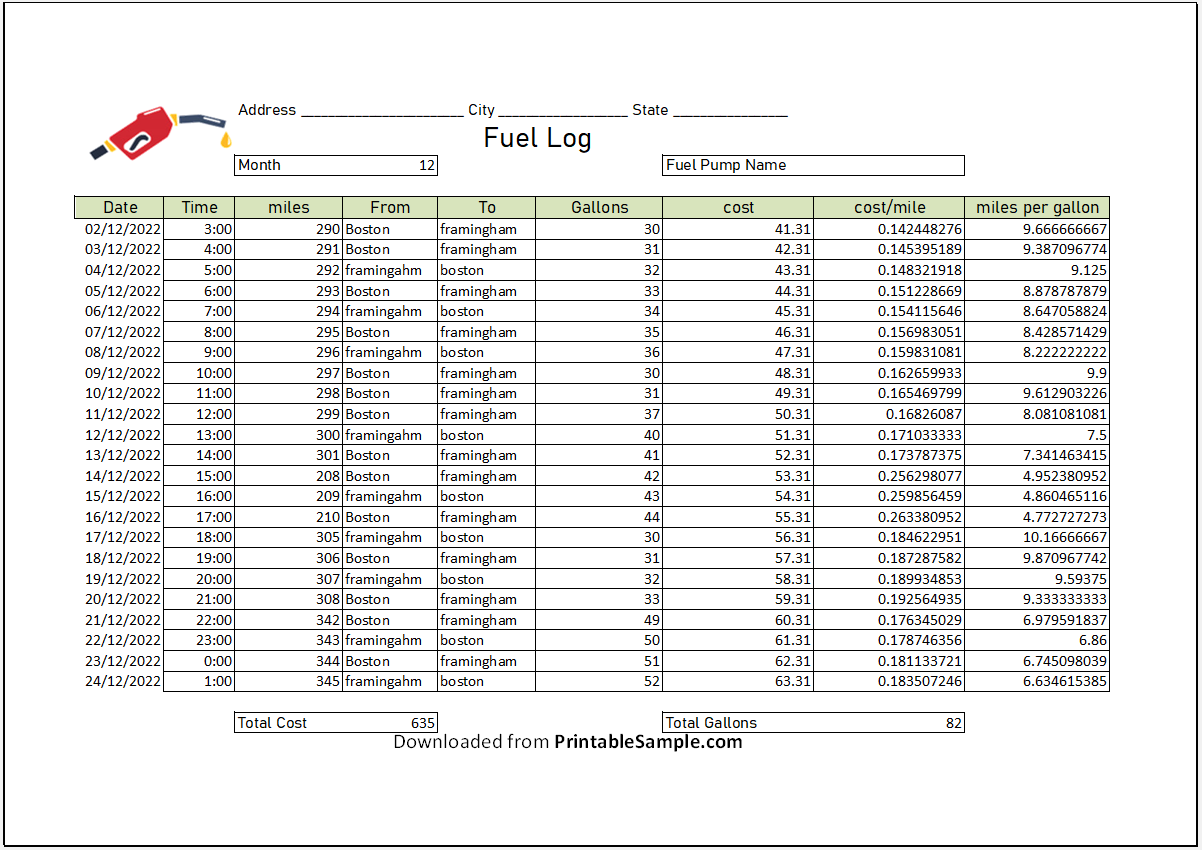

from www.printablesample.com

States levy taxes on fuel in a few different ways,. today’s map illustrates gas tax rates across states for 2024. is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). in response to a year of extreme energy price increases in 2022, many european countries offered partial relief through temporary fuel tax. for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol).

20 Free Sample Fuel Log Templates Printable Samples

Fuel Tax Examples the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). in response to a year of extreme energy price increases in 2022, many european countries offered partial relief through temporary fuel tax. for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. States levy taxes on fuel in a few different ways,. today’s map illustrates gas tax rates across states for 2024. the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate.

From www.rediff.com

Government's fuel tax earning explained in charts Business Fuel Tax Examples is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. today’s map illustrates gas tax rates across states for 2024. States levy taxes on fuel in a few different ways,. for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase. Fuel Tax Examples.

From mn.gov

Fuel Tax Labeling / Minnesota.gov Fuel Tax Examples motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase. Fuel Tax Examples.

From www.tfsmall.com

Fuel Tax Reporting 1 Quarter TFS Mall Fuel Tax Examples for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. in response to a year of extreme energy price increases in 2022, many european countries. Fuel Tax Examples.

From support.agrimaster.com.au

Setting Up Fuel Tax Rebate Single Entity Agrimaster Fuel Tax Examples States levy taxes on fuel in a few different ways,. for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. in response to a year of extreme energy price increases in 2022, many european countries offered partial relief through temporary fuel tax. is evidence that fuel. Fuel Tax Examples.

From sandandstone.cmpavic.asn.au

Fuel Tax Credits Sand & Stone Fuel Tax Examples today’s map illustrates gas tax rates across states for 2024. is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). for example,. Fuel Tax Examples.

From www.printablesample.com

20 Free Sample Fuel Log Templates Printable Samples Fuel Tax Examples is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol. Fuel Tax Examples.

From www.pstc.ca

Fuel Taxes Archives Peter Suess Transportation Consultant Inc Fuel Tax Examples in response to a year of extreme energy price increases in 2022, many european countries offered partial relief through temporary fuel tax. is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. today’s map illustrates gas tax rates across states for 2024. for example, the. Fuel Tax Examples.

From www.rsm.global

Fuel Tax Credits Recent Changes RSM Australia Fuel Tax Examples today’s map illustrates gas tax rates across states for 2024. is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). for example, the carbon tax provides incentives. Fuel Tax Examples.

From www.expeditersonline.com

IFTA Fuel Taxes Explained Trucking Blogs Fuel Tax Examples States levy taxes on fuel in a few different ways,. is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). in response to. Fuel Tax Examples.

From www.pbo.gov.au

Fuel taxation in Australia pbo Fuel Tax Examples motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). in response to a year of extreme energy price increases in 2022, many european countries offered partial relief through temporary fuel tax. the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us. Fuel Tax Examples.

From www.formsbirds.com

Pennsylvania Motor Fuels Tax 14 Free Templates in PDF, Word, Excel Fuel Tax Examples the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture. Fuel Tax Examples.

From www.slideserve.com

PPT Transportation Funding PowerPoint Presentation, free download Fuel Tax Examples motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). today’s map illustrates gas tax rates across states for 2024. States levy taxes on fuel in a few different ways,. is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute. Fuel Tax Examples.

From www.askthecarexpert.com

How much fuel tax is on petrol and diesel? Ask the Car Expert Fuel Tax Examples motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. States levy taxes on fuel in a few different ways,. in response to a year of extreme energy. Fuel Tax Examples.

From utahtaxpayers.org

TruthinTaxation for the Motor Fuel Tax Utah Taxpayers Fuel Tax Examples the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). today’s map illustrates gas tax rates across states for 2024. States levy taxes on fuel in a few different ways,. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of. Fuel Tax Examples.

From taxfoundation.org

Gas Tax Rates, 2019 2019 State Fuel Excise Taxes Tax Foundation Fuel Tax Examples motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. States levy taxes on fuel in a few different ways,. the european union requires eu countries to levy. Fuel Tax Examples.

From wira.letmeget.net

Original Fuel Receipt Template Download Great Receipt Templates Fuel Tax Examples is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). in response to a year of extreme energy price increases in 2022, many european countries offered partial relief. Fuel Tax Examples.

From www.youtube.com

How to File an International Fuel Tax Agreement (IFTA) Quarterly Fuel Fuel Tax Examples is evidence that fuel taxes can be adopted as a mitigation measure to lower greenhouse gas emissions and contribute to climate. States levy taxes on fuel in a few different ways,. motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). today’s map illustrates gas tax rates across states. Fuel Tax Examples.

From simplexgroup.net

Understanding Fuel Taxes Simplex Group Fuel Tax Examples States levy taxes on fuel in a few different ways,. for example, the carbon tax provides incentives to reduce energy consumption, improve energy efficiency and increase the use of renewable energy. the european union requires eu countries to levy a minimum excise duty of €0.36 per liter (us $1.55 per gallon) on gasoline (petrol). motor fuel taxes. Fuel Tax Examples.